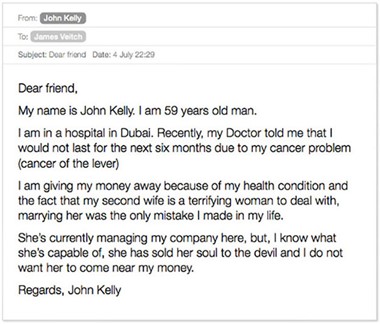

It was the early 2000s, and you would open your e-mail and see that some stranger with only a couple of days to live had decided to hand their massive inheritance to you.

For many people, this is what they imagine when they hear the word ‘phishing.’ In today’s world, the idea of such pursuit might seem laughable and sound like a rather uncreative effort of fraud. These e-mails would typically invite a couple of eye rolls if not end up in your spam box. However, scammers’ strategies in stealing your data and wealth have developed throughout the years. Thus, making users—even ones that are naturally skeptical—fall into the trap of these criminals.

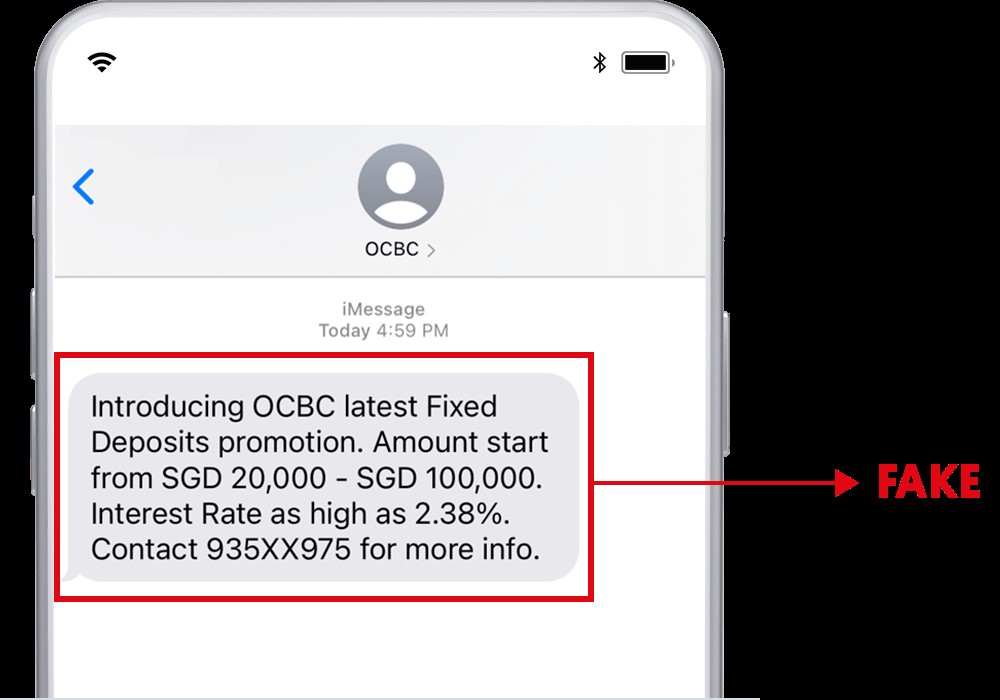

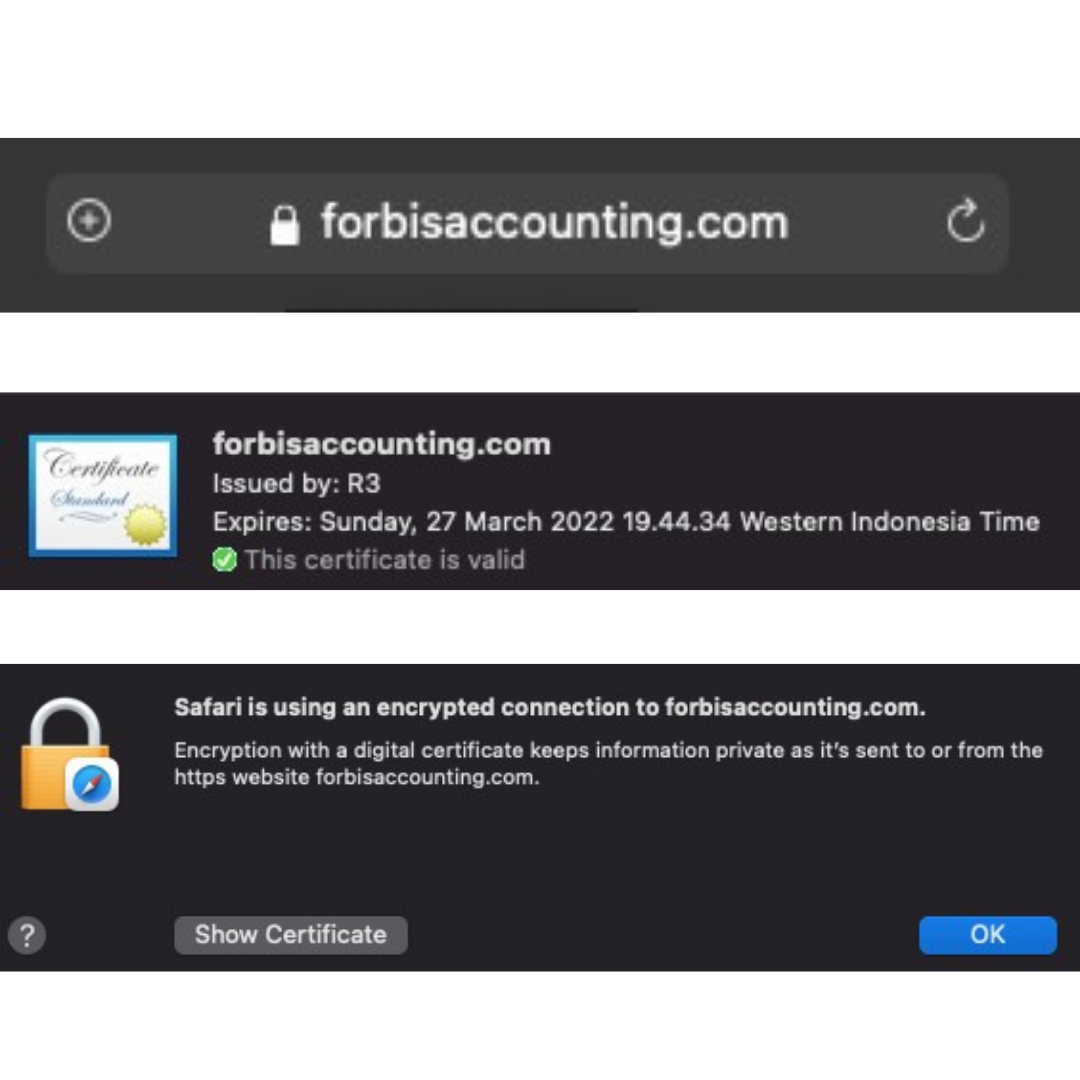

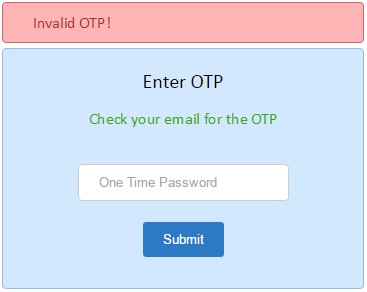

This situation is best illustrated in the latest case in Singapore that befalls a handful of OCBC customers whose money was wiped clean by scammers who managed to spoof a message from OCBC. This caused the customers to give away their OTP number, which allowed scammers to rummage through their bank account. This case has proven that scammers have found ways that might seem harmless when trying to deceive people.

What else should I do to avoid scammers?

In this digital age, online fraud has become a shared problem in the community. For that reason, we can never be too careful in making efforts to protect our sensitive data. It would make sense that the best shield in facing the negative side of technological advancement—in addition to the establishment of solid technological infrastructure—would be digital literacy and awareness. It is highly recommended that users change their password once in a while, ensure that personal information like banking details and passwords are kept secret from any parties, and contact customer service should they find anything suspicious.